Annuities: The Good, the Bad, and the Ugly

Happy Sunday! I had a bunch of questions about annuities after last week’s newsletter. If you missed last week’s newsletter, you can access the archives on my website here: https://theproactiveinvestor.com/blog/. Seems like the market dropping has reignited some fears of a market decline. I have talked about annuities before and I do believe they are, without a doubt, a NECESSARY tool for most retirees, but of course THEY ARE NOT RIGHT FOR EVERYONE! Furthermore, I am launching a webinar in soon titled, “Annuities, The Good, the Bad, and the Ugly.” So I thought why give folks a little preview to address some questions? Let’s go, starting with the UGLY.

The Ugly

Obviously, you have heard really negative things about annuities, but unfortunately, most people only hear what they are looking for. In other words, you are constantly influenced by all the people in your life. There is no doubt that the majority of people don’t understand annuities and what we don’t understand, we fear. Furthermore, we seek to validate our opinion when searching for information. Case in point, I love dogs. I have a buddy that hates them. Hate is a strong word, so why does he hate them? When he was a child, he grew up with a neighbor that had a very aggressive dog. The dog would growl and bark every time he was in the backyard playing. Additionally, he got bit by another dog who was a stray. These experiences forged a hateful perspective of dogs. Now, we know dogs are not demon spawn but you can certainly have negative experiences with even the most lovable of creatures.

Annuities are the same way. Annuities are actually a really powerful tool that can do things other investments cannot. Do they have some ugly things about them? Absolutely! However, when people read and hear about the negative things about annuities they find on Google or in the news, they most likely hear of aspects attributed to a specific type of an annuity, a variable annuity.

Variable annuities are one of the primary competitors to your brokers. They offer active money management, but have insurance-like guarantees. With these annuities, the money is invested in the stock market and managed professionally, however, there are provisions that guarantee income or a death benefit. While variable annuities are the riskiest of annuities, one of their biggest problems is that they are complicated. In fact, many variable annuities can have prospectuses that are hundreds of pages long. If it takes hundreds of pages just to describe what your investment does and offers, then we would have to agree that it can be complicated and confusing.

Additionally, an investment that is professionally managed and has a bunch of different guarantees and stipulations, is also going to be expensive. Variable annuities will have investment or management fees for all the funds or portfolios that range from 0.5% to 2.2%.Then, they have mortality and expense fees which will usually be around 1%. Then, you wanted guarantees right? Income guarantees and death benefit guarantees right? That’s another 0.5% to 1.5% for each guarantee.

So yes, you can see here that not only can this get complicated, but the fees start to pile up. The typical variable annuity CAN run you 3% to 6% per year.

Here’s a hypothetical, yet typical example:

A couple, let’s call them Jack and Diane, has had a $500,000 variable annuity for the past 7 years. In this hypothetical example, their investment fees come to 1% and their mortality expenses are 1.3%. The decide they want the income rider to provide them a lifetime income, that’s 1%. They also opted for the death benefit rider just in case. That’s another .5%. All total, that is 3.8% per year and this is typical of many variable annuity owners. How much has our couple paid?

Some of you are thinking, “Duh, you just said 3.8%. That’s $19,000.” Not quite! Remember, these fees are annual. This couple has owned this annuity for 7 years, paying this fee each year for those 7 years. So how would you feel if you’re Jack and Diane and I just showed you that you have paid $133,000 for your $500,000 investment?

Of course variable annuities can be a good tool for some investors. If you are younger and have a higher risk tolerance, variable annuities are a better alternative to mutual funds hands down, but I think we can agree they can be complicated and costly.

The Bad

Let’s move onto the BAD. “Bad” is an aspect of an annuity that isn’t necessarily ugly, but rather one that’s not really liked by most annuity critics. The one aspect of annuities that is disliked is liquidity.

Liquidity is just easy access to your money. An investment that is completely liquid, allows you to have 100% access to your money without any penalty. So what about annuities? Well, annuities do have limitations to their liquidity, but the majority of them offer, what’s known as 10% free withdrawals each year starting after your first year. That sounds like a big restriction to most, but let’s take a closer look at how much of an issue it might be for you:

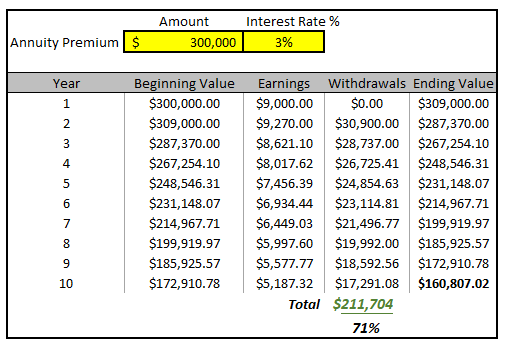

In the above chart, you have an example of a 10-year, $300,000 annuity. I fixed the rate for you at 3% interest per year. You, as the owner of this annuity, can take 10% of your balance each year starting in Year 2. Obviously, you’d only take the money out if you needed it such as for a down payment on your daughter’s new car or if you need a little home improvement project or (as a recent potential client asked) some money if you need to bail someone out! But assuming you take 10% out every year, you were able to take over 70% of your initial investment for various uses AND still have money to continue to invest!

So while annuities get a bad rap for this, the reality of it is that in a typical situation, you’d have pretty good access to your money. Real quick, how many of you would be comfortable with that much access to your money for those ten years? Here’s the other thing, annuities typically have built in provisions that allow you or your beneficiaries to have access to most or ALL of your money in the case of an emergency such as terminal illness, you being confined to a nursing home, or death. I think we can agree, that will there are limitations here, this is something most investors can live with.

The Good

So we’ve been though the UGLY and have noticed that those aspects are attributed to a specific kind of annuity (variable) and the BAD although we have seen that we have reasonable access to our investment. So what about the GOOD? There has to be some reasons why last year alone, people put $240 billion into annuities…yes, that is $240 billion!

First of all “GOOD” is only relevant to finding the right type of annuity for you. For those of you that are clients, you noticed we walked through your goals and needs and found something that fit. There are no “one-size-fits-all” annuities that just fit everyone. But if you choose the right type of annuity for your situation, they can be a principal-protected way to grow your money for retirement.

By working with someone who knows their stuff about annuities, you can select the right type of annuity for your goals. This gives you the opportunity to find a product that offers complete protection of your principal from any downside risk of the market, because all that risk is transferred to an insurance company and every dime of your principal is guaranteed. You have the chance to earn decent interest on your money by choosing the right annuity. You can have a guaranteed income for life and an enhanced death benefit. And finally, you can do this while paying very little to no fees at all.

One type of annuity that does all this is the fixed index annuity (FIA). Since they have the word “fixed” in them, the principal is guaranteed, but these annuities do something a little different to get you more interest. Their interest is linked to a market index, like the Dow Jones Industrial Average or the S&P 500 or others. The key here is the word “linked.” Unlike the variable, the money is NOT invested in the stock market so it cannot be lost like in a variable annuity. The FIAs guarantee your principal, but they are linked to a stock market index so this is like getting the best of both worlds: here you have a product that won’t lose any money if the market falls, but participates when the market goes up to earn you a higher interest rate.

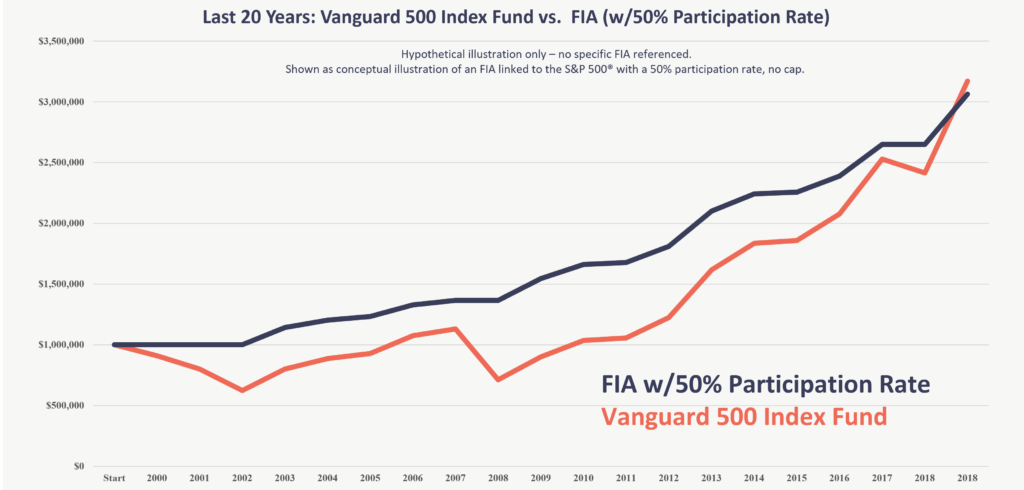

This is where many people, especially in or approaching retirement find the appeal in FIAs. Think about it: there’s no guessing, no worrying, no market timing, no picking stocks, no nothing. Look at the chart below:

In comparing a typical FIA with one of the more popular mutual funds out there, the Vanguard 500 Index Fund, you’ll note they end up in about the same place after 19 years. However they took different routes to get there. Notice the huge declines in 2000-2002 and 2007-2009? Also notice that in the same period, the FIA didn’t lose a dime. The mutual fund goes up faster, but can lose money. The FIA never loses and only participates if the market rises. The obvious question is, “Why would you put your money at more risk to arrive at the same spot?”

I hear you though, “Well Justin, I don’t make as much money in the FIA when the market goes up?” Yep, that’s a bummer, until you realize that is simply the price you pay to neverhave a down year. Wouldn’t you have to agree that that point alone is the most important aspect if you are in or as you approach retirement: NOT LOSING MONEY?

I remember when I’d teach a Futures class for the leading education company at the time. I would have people come up to me afterwords and ask me if I would manage their money for them. Often, this would be a large amount. I even had an offer to START with $3 million and if I did well, the gentleman would bring “a bunch more” to the table. However, if I talked to that same guy about investing $200,000 into an annuity, the response would most likely be negative. Again, this is because we fear and never take action on things we don’t understand, but things we are familiar with (regardless of whether we truly understand it) we go guns a blazin’ even if we have no real clue of what we are doing. This is sadly the insanity of people’s approach to the market: they are gambling when the think their being smart.

The GOOD of annuities is exactly what the majority of my clients are seeking in their retirement. They’ll gladly take a little less interest earnings to ensure they never suffer a big loss, which is exactly what a fixed index annuity is built to do. Think about it:

COVID has another increase and the market drops; You: “It doesn’t matter, I’m protected.”

COVID largely goes away and the market rallies; You: “Great! My annuity is making money.”

The presidential election results come in and the market drops; You: “It doesn’t matter, I’m protected.”

The presidential election results come in and the market rallies; “Great! My annuity is making money.”

If you are anything like my current clients, this piece of mind is priceless.

The Bottom Line

We’ve covered the UGLY of annuities which can be the high costs and complexity that is associated with variable annuities. We then talked about the BAD which is usually the perceived lack of liquidity of annuities, but we did show that there is at least 70% accessibility to your deposit over the life of the annuity and even 100% access in some circumstances. Then finally, we talked about the GOOD of annuities which involved key features that make them powerful tools in retirement, such as their upside potential, complete protection from market risk, and the ability to provide a lifetime, guaranteed income.

Annuities are powerful tools for retirement, but be sure to get the help you need to see if they are a proper fit in your investing.

THIS is what an active trader knows about proper investing. Put simply, if you want a better approach to your investing, one that more closely reflects how the SMART money invests, you must do what the SMART money does.

If you want to talk investments, give me a call 814-418-4000

Sincerely,

Justin Krebs

theproactiveinvestor.com

Ready to take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend an orientation.