Diversifi….confused? What an active trader knows about PROPER diversification

Before we get to our topic, let me take a few moments to compliment some of my newest clients. They took the time and the chance to be proactive. Remember, procrastination is risk. The longer we delay action, the more risk we create. Kudos to those of you that have taken action this week and having the trust in me to help.

Now, onto the show….

People think they understand diversification. They understand it is good. Their advisor says it is good. BUT they’re not diversified.

So what is diversification? Proper diversification is allocating parts of your portfolio into NON-CORRELATED assets. Note, non-correlated. Thus the problem with you or your broker thinking a mutual fund or a bunch of mutual funds is diversification is that you may be diversified against business risk but not against market and systematic risk.

Diversification is also dynamic. The amount (usually a percentage) that you allocate to each asset MUST change based on market conditions. I know, I know. You’re thinking you can’t time the market. B.S! What do you think investment companies like Goldman Sachs do every single day? Obviously, we aren’t timing the market every day, but seeing where the market is over each quarter, each year, etc is a NECESSARY part of investing. Buy and hold only works if you are LUCKY enough to catch it near the bottom or sell out near the top, which incidentally is TIMING the market. It may be luck, but it is still timing.

Anyway, I digress. Allocating more to markets that are undervalued or taking money away from markets that are overvalued is smart. This is what my background as an active trader taught me: markets are not static so why is your approach to the market?

Diversification as a Tool

Tools provide you many different advantages. My father was in construction. Growing up he taught me about many different tools to use when building things. Now think about it, when a construction crew is on the job site, do they want more tools or less tools? More obviously! Why? Because the more tools, the more ways they have to manage risk, create opportunity, and provide more efficiency.

Diversification is a tool for your retirement, because it does the same things. The better we PROPERLY diversify, the better we manage risk, the more opportunities we can pursue, and the more efficient and flexible we are.

So what do we do?

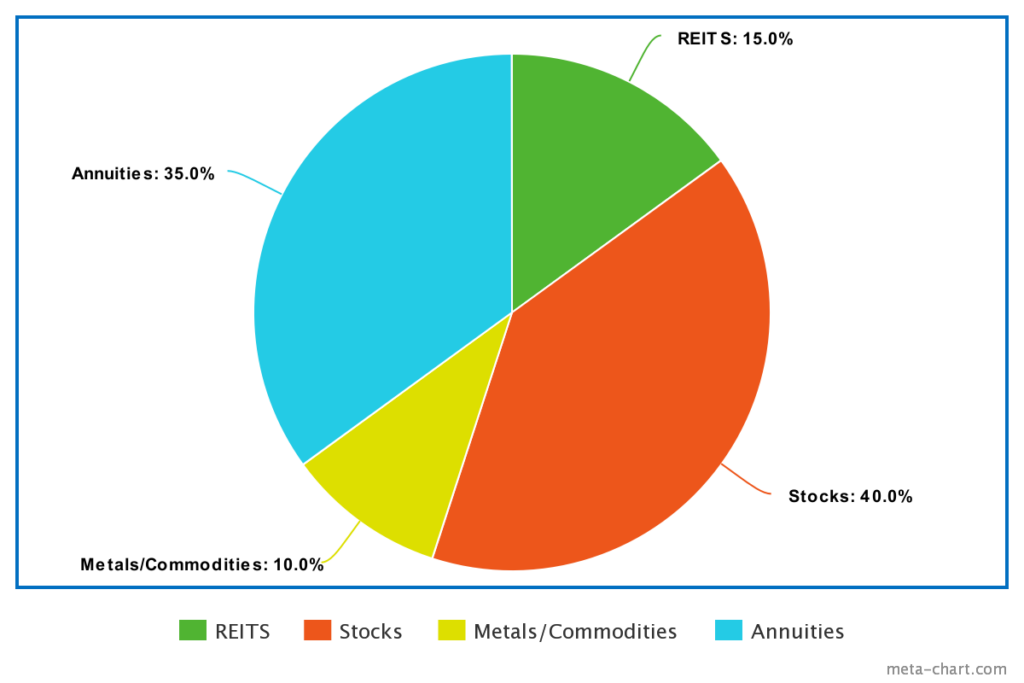

So where do we put our money and how much? Well, we want to dynamically allocate money to non-correlated assets with multiple tools. For the most part, a mixture of stocks, annuities, metals/commodities, and REITs. We also will use options to hedge our risks and provide an additional option to make money.

Why stocks? Not a lot of things have outperformed stocks over time. So why not just have most of our money in stocks? Because they also get crushed hard when shifts in the economy happen. High reward = high risk. We will talk about how to use stocks and ETFs (not mutual funds) in next week’s issue.

Why metals and commodities? These offer assets that perform well in economic uncertainty and inflationary periods.

Why REITs (Real Estate Investment Trusts)? Do you want the benefits of real estate without the huge capital outlay and lack of liquidity? Many people found out how illiquid real estate was in 2009 and are right on wanting to invest differently.

Where are bonds? Scratch bonds, seriously scratch them! Annuities do everything a bond does but better. Want protection? Annuities protect like bonds. Want income? Annuities provide better income than bonds. Want accumulation? Bonds don’t really accumulate much. Annuities do. Want tax deference? Bonds are taxable (except munis but you get less yield for the tax benefit) but annuities are tax-deferred. Yields on fixed index annuities have outperformed bonds over the last 100 YEARS! So why are you in bonds? Because everyone tells you to? Annuities are far better vehicles for this slice of our portfolio.

Hold up, I said something about options? Aren’t those risky? Google opinions strike again! Did you know the whole reason options were created? To give investors another way to HEDGE risk, not create risk. They are similar to an insurance contract. Do you consider insurance risky? Probably not.

So here is what it looks like (these numbers are dynamic and not how you should always have your portfolio balanced):

If this is not how your retirement is structured, you show seriously question why. My last 5 clients had over 85% their assets in stocks, mutual funds, index funds (which all track the SAME STUFF). If the market goes down hard in the next year or so, could you deal with 30%-50% of your retirement money disappearing? The most crucial years of your retirement are the 2 years before and the 3 years after you retire. Statistics show that it is incredibly difficult to recover your retirement monies if you experience a loss in these years.

Anyway, I have given you a lot to digest in this week’s newsletter. Hopefully you have enjoyed this perspective. THIS is what an active trader knows about proper investing.

In next weeks issue we will tackle a better way to invest in stocks for your investing. The following weeks we will cover each piece of our portfolio.

If you want to talk investments, give me a call 814-418-4000

Sincerely,

Justin Krebs

theproactiveinvestor.com

Ready to take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend an orientation.